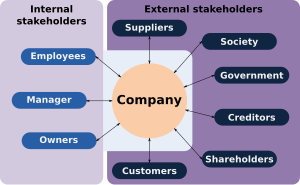

Stakeholder approach

Contents

Utility

Competitive advantage

This approach is more able to create competitive advantage because it creates a link between the firm and stakeholders. The latter will perceive the coherent application of the organizational values and will relate those values with his own. In that way, the company will have the needed information about stakeholders in order to treat them well and develop important initiatives. By doing that, the firm’s reputation and loyalty will be reinforced among customers and other stakeholders alike, it will create stronger brand recognition and will increase trust in the firm. Even if there are limits in loyalty and reputation can be damaged, those two key elements can make a big difference creating barriers to other companies that may want to have information about stakeholder utility functions. A firm that follows the stakeholder approach will get the information needed to work for satisfying the stakeholders’ needs, making it easier to develop expertise. Those acquired skills can be transmitted, promoted and reinforced across the business operation of the firm creating core competencies. Over time, this approach can become an indispensable issue in the organizational culture.[4][5]

Value creating through innovation

Firms that manage for stakeholders are more able to attract a higher-quality workforce. Employees’ job satisfaction has an impact on the firm’s ability to foster innovation. Workers who are satisfied with their jobs are more likely to engage in long-term thinking and generate potentially valuable ideas. Those firms can use information about stakeholder to devise new ways of satisfying them.[6] Reciprocity is a key aspect in this approach: when stakeholders stand to benefit, they are more likely to reveal information about their utility function. That is why firms and firm managers can better meet consumers' needs by understanding their own customers and suppliers and using this information strategically and flexibly.[5]

Limits

Divergent interests

The implication of all the stakeholders may produce divergent views making it difficult to reach consensus.[7] Each stakeholder may care mostly about its own benefits or self-interests.[8] Trying to satisfy a large number of players will complicate governance.[citation needed] It can result in time consuming in engaging all the parties. Moreover, in this approach, an equality of stakeholders and business is implied in negotiating issues of mutual interest. That assumption has been critiqued in terms of an inequality of resources, negotiating power and time required. The identification of prices and opportunity costs for the different stakeholders difficult and reduce the operability of this approach.[7]

Overvaluing stakeholders

It has been suggested that obtaining information about stakeholders' utility functions may produce costs that can exceed the benefits. Therefore, in its intention to create value, managing for stakeholders can end up allocating too many resources to stakeholders. Also, having into account that the power among stakeholders is not equal, some powerful actors can get much of the firm’s profitability. And with that distribution of value, shareholders cannot expect a maximization of returns.[5]

External links

- Negotiation power - Program on negotiation. Harvard Law School

- Innovation - Australian government. Department of Industry, Innovation and Science.

References

- ↑ Lua error in Module:Citation/CS1/Identifiers at line 47: attempt to index field 'wikibase' (a nil value).

- ↑ Lua error in Module:Citation/CS1/Identifiers at line 47: attempt to index field 'wikibase' (a nil value).

- ↑ Freeman, R. Edward; Harrison, Jeffrey S.; Wicks, Andrew C.; Parmar, Bidhan L.; Colle, Simone de (2010-04-01). Stakeholder Theory: The State of the Art. Cambridge University Press. ISBN 9781139484114.

- ↑ Maignan, Isabelle; Gonzalez, Tracy; Hult, Tomas; Ferrell, O.C. (25 July 2011). "Stakeholder orientation: development and testing of a framework for socially responsible marketing". Journal of Strategic Marketing. 19: 313–338.

- ↑ 5.0 5.1 5.2 Lua error in Module:Citation/CS1/Identifiers at line 47: attempt to index field 'wikibase' (a nil value).

- ↑ Lua error in Module:Citation/CS1/Identifiers at line 47: attempt to index field 'wikibase' (a nil value).

- ↑ 7.0 7.1 O’Haire, Christen; McPheeters, Melissa; Nakamoto, Erika; LaBrant, Lia; Most, Carole; Lee, Kathy; Graham, Elaine; Cottrell, Erika; Guise, Jeanne-Marie (2011-06-01). Strengths and Limitations of Stakeholder Engagement Methods. Agency for Healthcare Research and Quality (US).

- ↑ "The Risks of Relying on Stakeholder Engagement for the Achievement of Sustainability (PDF Download Available)". ResearchGate. Retrieved 2017-05-06.